Content

Under new simplified IRS guidelines for home office expenses, home-based small businesses and freelancers can deduct five dollars per square foot of your home that’s used for business purposes, up to a maximum of 300 square feet. The The Rules For Deducting Business Expenses On Federal Taxes modified adjusted gross income you report on your tax return is used to determine if you qualify for certain tax benefits. Most small business tax deductions are more complicated than this brief overview describes—it is the U.S.

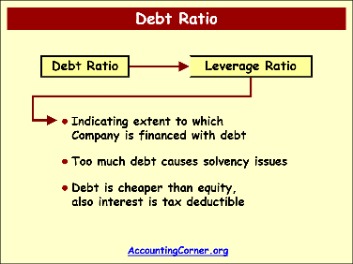

You generally deduct a cost as a current business expense by subtracting it from your income in either the year you incur it or the year you pay it. You are included among possible beneficiaries of the policy if the policy owner is obligated to repay a loan from you using the proceeds of the policy. A person has a financial interest in your business if the person is an owner or part owner of the business or has lent money to the business.

Home Office Expenses

Although you generally cannot take a current deduction for a capital expense, you may be able to recover the amount you spend through depreciation, amortization, or depletion. These https://quick-bookkeeping.net/what-is-the-difference-between-supplies-materials/ recovery methods allow you to deduct part of your cost each year. In this way, you are able to recover your capital expense. See Amortization and Depletion in this publication.

Generally, you can deduct a casualty loss on property you own for personal use only to the extent each casualty loss is more than $100, and the total of all casualty losses exceeds 10% of your adjusted gross income . An activity is presumed carried on for profit if it produced a profit in at least 3 of the last 5 tax years, including the current year. Activities that consist primarily of breeding, training, showing, or racing horses are presumed carried on for profit if they produced a profit in at least 2 of the last 7 tax years, including the current year. The activity must be substantially the same for each year within this period. You have a profit when the gross income from an activity exceeds the deductions. You generally cannot deduct expenses in advance, even if you pay them in advance.

Business meals

However, legal fees you pay to acquire business assets usually aren’t deductible. These costs are added to the basis of the property. Your employees must adequately account to you for their travel and non-entertainment-related meals expenses. They must give you documentary evidence of their travel, mileage, and other employee business expenses.

- These rules also apply to the deduction of development costs by corporations.

- In business, an asset is a resource that has value and can be converted to cash.

- Extracting ores or minerals from the ground includes extraction by mine owners or operators of ores or minerals from the waste or residue of prior mining.

- First, the expense must be considered ordinary and necessary for your business.

- To elect to amortize qualifying reforestation costs, complete Part VI of Form 4562 and attach a statement that contains the following information.

You elect to capitalize circulation costs by attaching a statement to your return for the first tax year the election applies. Your election is binding for the year it is made and for all later years, unless you get IRS approval to revoke it. Generally, if you dispose of the mine before you have fully recaptured the exploration costs you deducted, recapture the balance by treating all or part of your gain as ordinary income. Under these circumstances, you generally treat as ordinary income all of your gain if it is less than your adjusted exploration costs with respect to the mine. If your gain is more than your adjusted exploration costs, treat as ordinary income only a part of your gain, up to the amount of your adjusted exploration costs.

What is the qualified business income deduction?

Your client’s records should not include any personal expenses. The following is a brief list of some common business expenses. See the Schedule C instructions and IRS Publication 535, Business Expenses, Publication 946, How to Depreciate Property, and Publication 587, Business Use of the Home, for more information. The IRS usually requires you to deduct major expenses over time, rather than all at once, as capital expenses.

Be sure to keep documentation for the outing that includes the amount of each expense, the date and place of the meal, and the business relationship of the person you dined with. A good way to do this is to record the purpose of the meal and what you discussed on the back of the receipt. However, you cannot deduct amounts paid to influence legislation (i.e., lobbying) or sponsor political campaigns or events. As a small business owner, it can be difficult to know what deductions are relevant to you.

Pass-Through Tax Deduction

The cost of changing from one heating system to another is a capital expense. 538 and section 263A and the related regulations. The cost of products or raw materials, including freight. For the latest information about developments related to Pub. 535, such as legislation enacted after it was published, go to IRS.gov/Pub535. Reimbursement of Travel and Non-Entertainment-Related MealsReimbursementsAccountable PlansAdequate accounting.

- Aggressive and threatening phone calls by criminals impersonating IRS agents remain near the top of the annual Dirty Dozen list of tax scams for the filing season.

- Considered to be selling oil or natural gas through a related person who is a retailer if all of the following apply.

- When determining the term of the transfer agreement, include all renewal options and any other period for which you and the transferor reasonably expect the agreement to be renewed.

- For details and more information about filing a claim, see Pub.

Extracting ores or minerals from the ground includes extraction by mine owners or operators of ores or minerals from the waste or residue of prior mining. This does not apply to extraction from waste or residue of prior mining by the purchaser of the waste or residue or the purchaser of the rights to extract ores or minerals from the waste or residue. Multiply the result figured in by a fraction, the numerator of which is the result figured in and the denominator of which is the result figured in . This is your depletion allowance for that property for the year. To any person given authority under an agreement with you or a related person to occupy any retail outlet owned, leased, or controlled by you or a related person.