Content

An efficient costing system is an important factor for industrial control. In organizations, cost accounting is an internal aspect that measures operational efficiency and assists the management to maintain the lowest possible costs, consistent with efficient operating conditions. Ledger accounts that contain transactions related to individuals or other organizations with whom your business has direct transactions are known as personal accounts. Some examples of personal accounts are customers, vendors, salary accounts of employees, drawings and capital accounts of owners, etc.

Based on the exchange of cash, there are three types of accounting transactions, namely cash transactions, non-cash transactions, and credit transactions. List and describe five differences between financial accounting and managerial accounting. Explain the major similarities and differences in accounting for for-profit and not-for-profit organizations. Be sure to consider differences in organizational ownership, fund accounting, and financial reporting. Describe the difference between cash basis and accrual basis accounting. Identify one type of organization that might prefer cash basis accounting.

The Best Inventory Management Software: Zoho Books

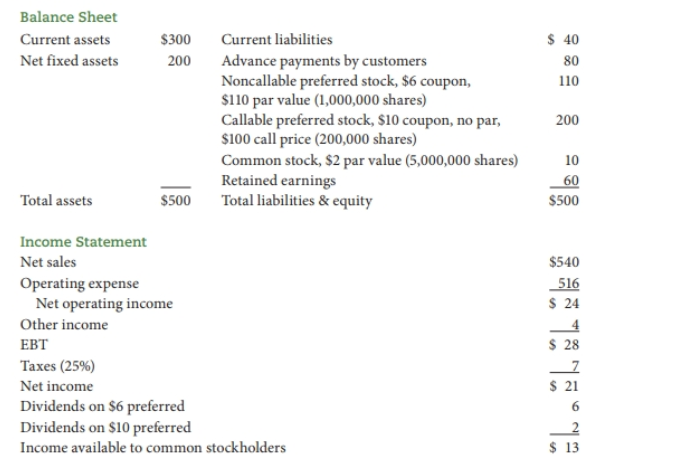

If the corporation realizes a profit, it is paid out to shareholders who must then report it as income and pay taxes on it at the individual rate. A shareholder in a privately held corporation must sell his interest to regain his investment. In a publicly held corporation, a shareholder can trade his shares on the open market. A partnership entity has two or more owners sharing equal control, unless the partnership agreement states otherwise or the structure is set up as a limited partnership.

List some of the major differences in accounting between IFRS and U.S. Summarize the key differences in accounting for partnerships versus accounting for corporations. Explain differences between accounting practices around the world. List and describe the two types of accounting standard pronouncements. Describe how the four types of adjusting entries would be recorded in a computerized accounting system.

List of Examples – 3 Types of Accounts

By the time of Emperor Augustus, the Roman government had access to detailed financial information. The best accounting software for your company depends on your unique needs, as well as what industry you’re in. To give you a starting point for your software search, here are our top picks for the five most common types of accounting software. Often working hand in hand with three types of accounting accounts receivable, invoicing software makes it easy to write and send professional invoices with minimal design effort and automatic data transfer. This software is especially useful for service companies, ensuring timely billing and payment for services rendered. Accounts payable is a record of the short-term debts a business owes to suppliers and other creditors.

- Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

- The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities.

- IFRS , are standards that are widely adopted in financial accounting.

- Publicly traded companies are required to follow the Generally Accepted Accounting Principles when preparing their financial reports for reporting or for investors.

- An accounting error is an unintentional misstatement or omission in the accounting records, for example misinterpretation of facts, mistakes in processing data, or oversights leading to incorrect estimates.

- Standards for international audit and assurance, ethics, education, and public sector accounting are all set by independent standard settings boards supported by IFAC.

- So, the accounting book of the company would look weak until the revenue actually came in.

All original content is copyrighted by SelectHub and any copying or reproduction is strictly prohibited. Acumatica enables users to track and view detailed summaries of their accounts and budgets. Prepare the adjusted trial balance to ensure these financial balances are materially correct and reasonable. However, lenders also typically require the results of an external audit annually as part of their debt covenants. Therefore, most companies will have annual audits for one reason or another.

Payroll Software

These rules are set by the Financial Accounting Standards Board and are designed to promote consistency in the reporting process, so Company A will use the same reporting methodology as Company B. If you’re just getting through accounting 101, you’re probably still a little unclear about the various types of accounting fields being used today. Identify the different types of receivables and explain how companies recognize accounts receivable.

GAAP differs from the accounting treatment for other intangible assets. Fixed CostFixed Cost refers to the cost or expense that is not affected by any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is not dependent on the business activity.